Retirement & Succession Planning

Moving from Accumulation to Sustained Income.

Retire without outliving your capital. Pass a business forward without family conflict. We build tailored income streams and clear succession pathways that navigate tax, liquidity, and generational change with precision. This is not a single number—it's a dynamic, resilient strategy.

The Retirement Horizon: From Accumulation to Distribution

Retirement planning is a multi-phase journey. We map your income gap, structure phased withdrawals, and mitigate longevity risk with transparent, evidence-based strategies.

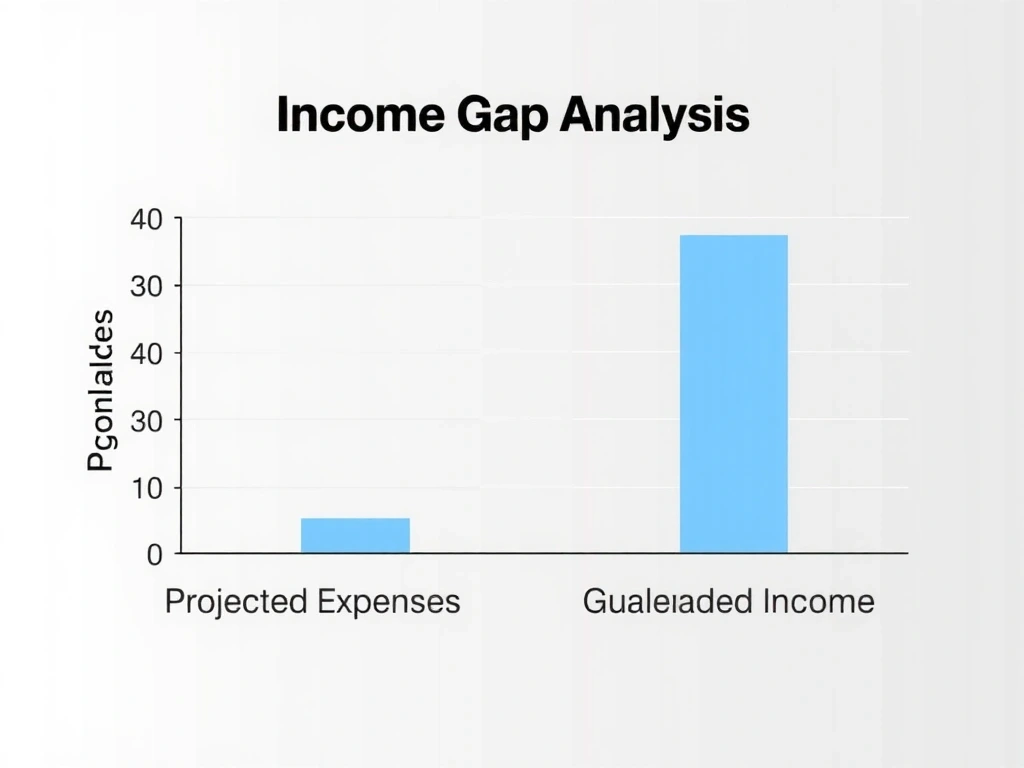

Phase 1: The Income Gap

We quantify the shortfall between projected expenses and guaranteed income (pensions, social security). This becomes the target our investments must sustainably fund.

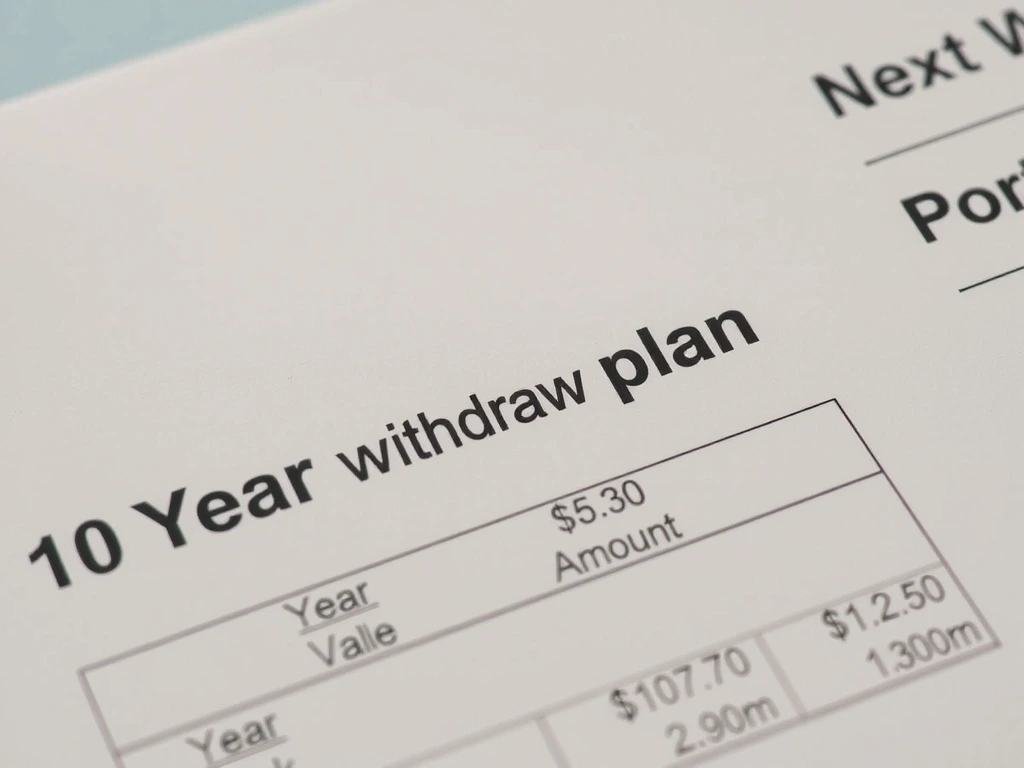

Phase 2: Phased Withdrawals

Asset allocation shifts dynamically. Pre-retirement: growth-oriented. Post-retirement: income-generating and capital preservation. The order of taxable, tax-deferred, and tax-free accounts is optimized to minimize lifetime tax.

Phase 3: Longevity & Inflation

We structure portfolios for 30+ years using tools like bond ladders as a safety net. A 5-7% annual increase is built into the plan to preserve purchasing power against inflation.

Data Source: Based on client-provided cash flow projections and government pension estimates. All figures are hypothetical and for illustrative planning purposes only.

Assumption Footnote: Calculations assume a 5% nominal annual return and 3% inflation. Actual results will vary and are not guaranteed.

Core Principle

Retirement income must be resilient to market volatility and personal longevity.

Methodology

We stress-test plans against 1,000+ market scenarios, not historical averages alone.

Outcome

A clear, tax-aware strategy that balances current lifestyle with legacy goals.

Succession Planning: The Three Pillars

Business and wealth succession are an integrated strategy. We structure transitions around three pillars: valuation, governance, and liquidity.

Valuation & Sale Strategy

We use DCF and market multiples to establish a fair value. The sale structure (seller note, earn-out) is designed to maximize after-tax proceeds and align with your financial goals.

Family Governance Charter

A clear framework defining roles, decision rights, and conflict resolution for heirs. Prevents fragmentation and ensures the business outlives the founder's vision.

The Liquidity Bridge

Using life insurance or a sinking fund to provide immediate cash for estate taxes or buyout agreements. Ensures the business isn't forced into a fire sale to meet obligations.

Key Terms & Our Stance

Planning involves jargon. Here’s what these terms mean in practice—and how we view them.

Nachhaltige Geldanlage

Sustainable investing.

Our Stance: We prefer SFDR Article 8/9 funds, but client-defined ESG criteria override generic labels. Liquidity and diversification remain non-negotiable.

Erbschaftsteuer

German inheritance tax.

Our Stance: Annual modeling is critical. We often use gifting strategies and specific insurance structures within legal limits to optimize the tax burden.

Buy-Sell Agreement

A contract between co-owners for business share transfer.

Our Stance: Must be funded by key-person insurance or a sinking fund. A handshake agreement is a plan waiting to fail.

Seller Note

A promissory note from the buyer to the seller.

Our Stance: Useful for tax deferral and buyer financing, but requires rigorous credit analysis. We balance terms to protect seller income streams.

Case Study

The Müller Family Succession

The Challenge

A 2nd-generation manufacturing owner in North Rhine-Westphalia sought retirement. His three children were divided: two active in the business, one pursuing a separate career. The goal: ensure a fair transition without triggering conflict or a forced sale.

-

1.

Discovery & Blind Valuation

We conducted a market-based valuation without client bias. Mapped each child's personal financial goals and risk tolerance separately.

-

2.

Structured Buyout

Created a 7-year seller-financed note for the non-active child. The note was secured by a key-person insurance policy on the active siblings.

-

3.

Family Charter Workshop

Facilitated a governance document outlining dividend policies, future investment decisions, and a clear conflict resolution protocol.

Outcome:

Tax-optimized transition completed in 18 months. Business continues under the active siblings. Founder's retirement income is secured. Family harmony is preserved.

Anonymized case study based on a real client engagement. Specific figures and names changed for confidentiality.

Our Succession & Retirement Planning Framework

A structured, six-step process designed to build confidence and clarity, from initial discovery to living implementation.

Discovery & Goal Mapping

90-minute workshop to define personal, financial, and legacy objectives using our proprietary goal-setting canvas.

Comprehensive Diagnostic

Aggregate all assets, liabilities, and legal documents (wills, trusts, business agreements) for a 360° view.

Scenario Modeling

Monte Carlo simulations stress-tested against 1,000+ market and economic scenarios to test plan resilience.

Strategy Blueprint

A written document outlining specific recommendations, product structures, and a 12-month action plan.

Implementation & Coordination

We act as quarterback, coordinating with your lawyer, accountant, and insurance specialists to execute the plan.

The Living Review

Bi-annual check-ins with a formal review of performance, life changes, and regulatory updates.

Ready to Clarify Your Financial Future?

We offer a complimentary, 30-minute introductory call to discuss your specific retirement and succession goals. No obligation, no sales pitch—just clarity on our fee-only model.

Mon-Fri: 9:00-18:00 CET