Sustainable Investing, Engineered for Durability.

We integrate Environmental, Social, and Governance criteria not as a marketing layer, but as a fundamental lens for identifying resilient, future-ready businesses. For clients in Germany and the U.S. seeking capital alignment with long-term values.

Request Your ESG Alignment Review

We respond within one business day. All information is handled confidentially.

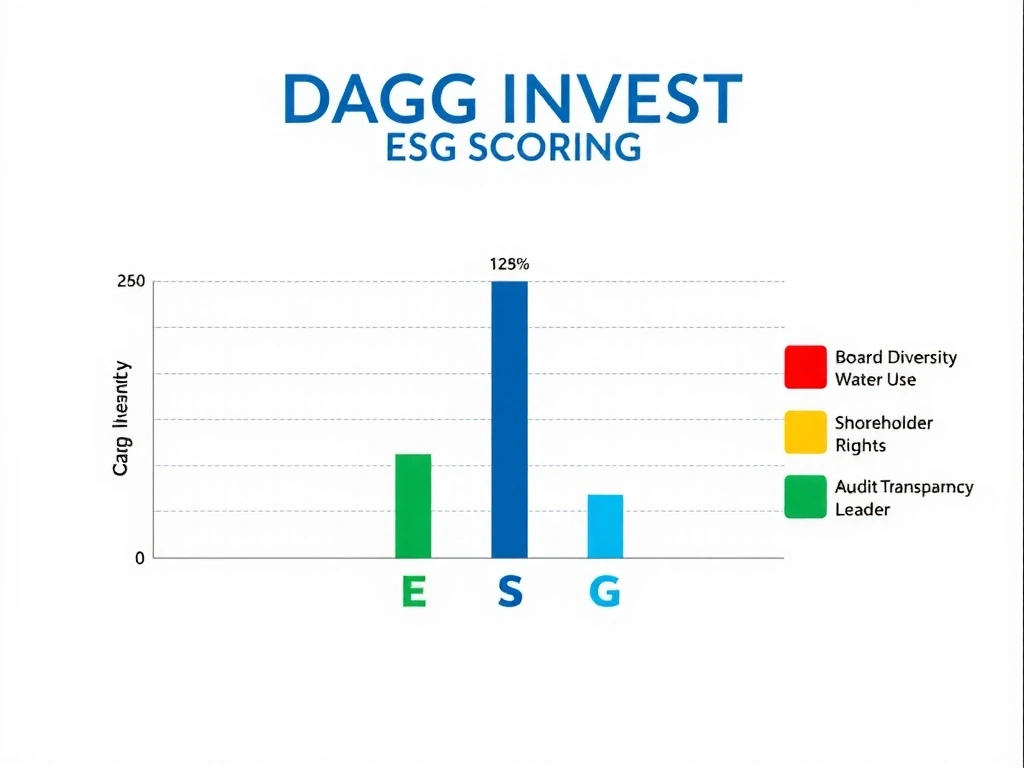

The ESG Framework in Practice

We move beyond generic ESG labels with a proprietary matrix evaluating over 150 data points per asset. This isn't about finding perfect companies; it's about understanding the 'why' behind the data and aligning capital with measurable impact.

Environmental: Beyond Carbon

We analyze resource efficiency, water stress, and circular economy adoption. A high carbon score is a starting point; we investigate supply chain decarbonization plans.

Social: Human Capital Integrity

We assess labor practices, data privacy, product safety, and community impact. Avoids companies with unresolved human rights allegations.

Governance: Non-Negotiables

Audit transparency, board independence, and executive compensation alignment are baseline requirements. We vote proxies to drive accountability.

Is Our ESG Alignment Right For You?

Decision Lens: Core Criteria

Tax Residency & Jurisdiction

We require disclosure of primary tax residency (Germany/US) to ensure proper ESG reporting and regulatory alignment.

ESG Preference Definition

We work with you to define what 'sustainable' means—whether it's climate focus, gender equality, or governance.

Liquidity Requirements

ESG screening can affect sector exposure. We document liquidity needs upfront to avoid future constraints.

Long-Term Horizon

Our sustainable strategies are designed for a 5+ year horizon. Short-term trading is not a fit.

What it optimizes for: Aligned values, regulatory compliance, long-term resilience. What it sacrifices: Access to certain high-yield speculative sectors, potentially higher concentration in specific themes.

Trade-off Analysis

Mitigation: For diversification, we use thematic funds and broad indices with high ESG scores. For regulatory complexity, our dual-jurisdiction expertise (DE/US) handles reporting requirements. Our fee-only model ensures cost transparency, and we use our voting rights to drive change at portfolio companies.

Beyond Buzzwords: Evidence & Common Traps

Sustainable investing is rife with ambiguity. We define our terms and flag common pitfalls that can derail a well-intentioned strategy.

Glossary: Terms & Our Stance

- SFDR Article 8

- A regulatory label for 'light green' funds promoting ESG characteristics. We favor Article 8 over Article 9 for most clients due to its scalability and liquidity.

- Impact Investing

- Targeting measurable, positive social/environmental outcomes alongside financial return. Often misused. We treat it as a specific subset, not the entire ESG space.

- Greenwashing

- Marketing-driven ESG claims that lack operational substance. Our verification process is designed to filter this out via third-party audits and supply-chain analysis.

- Transition Finance

- Financing high-emitting companies with credible decarbonization plans. We allocate to 30% transition companies within themes, with strict milestone requirements.

Common Failure Modes

1. Over-Reliance on Agency Scores

Mistake: Blindly following MSCI or Sustainalytics ratings.

Avoid: We triangulate data, engaging directly with companies to understand discrepancies between score and reality.

2. Ignoring Sector Constraints

Mistake: Excluding entire sectors (e.g., energy) without assessing transition potential.

Avoid: We use a 'best-in-class' approach within sectors, coupled with active engagement to drive change.

3. Neglecting Governance

Mistake: Focusing solely on 'E' and 'S' while overlooking board accountability.

Avoid: Governance is the largest weighting in our matrix. We assess shareholder rights and audit quality as foundational.

Client Scenario: The 'ESG' Directive

The Context: A German HNWI client, retiring in 2028, wants an 'ESG portfolio' but has no clear criteria.

Our Process: We conduct a values assessment, identifying 'health' and 'urban resilience' as priorities. We build a custom portfolio using our Sustainable Cities and Health themes, avoiding generic 'green' funds. We document all holdings and scorecards, showing the client exactly how each holding aligns with their defined priorities, not a generic label. This avoids the common pitfall of 'greenwashed' global funds with poor governance.

Principles

- Fee-Only Advisory

- Independent & Unbiased

- Full Transparency

Regulation

DAGG INVEST GmbH is a registered financial services provider in Germany, complying with BaFin regulations. Licensed for cross-border services in the U.S.