Client Scenario

A tech founder with concentrated stock options needs a liquidity and tax strategy that most institutions miss.

Our independent advisory blueprint begins with a holistic financial diagnosis—mapping assets, liabilities, and life goals—before any strategy is proposed. We eliminate commission bias, aligning our success directly with your portfolio growth. The result: a structured path from liquidity needs to long-term wealth preservation.

Pitfalls in DIY Advisory

01. Misaligned Incentives

Commission-based products create hidden costs. Our fee-only model makes our revenue transparent, aligning with your net returns.

02. Emotional Trading

During volatility, humans often sell low. We provide a disciplined framework (Investment Policy Statement) to prevent emotional missteps.

03. The "Sunday Night" Problem

When markets close on Friday, issues don’t. We provide a single point of contact for weekend or pre-market decisions, managing anxiety.

Constraint Management

We actively build portfolios around specific, documented constraints. This is where generic models fail.

Scenario: Moving from Germany to the US. Assets must be restructured for tax efficiency without triggering events.

Trade-off: Liquidity is documented upfront; it may limit access to certain high-yield, lock-up instruments.

The Long-Term Engine: Evidence-Based Growth

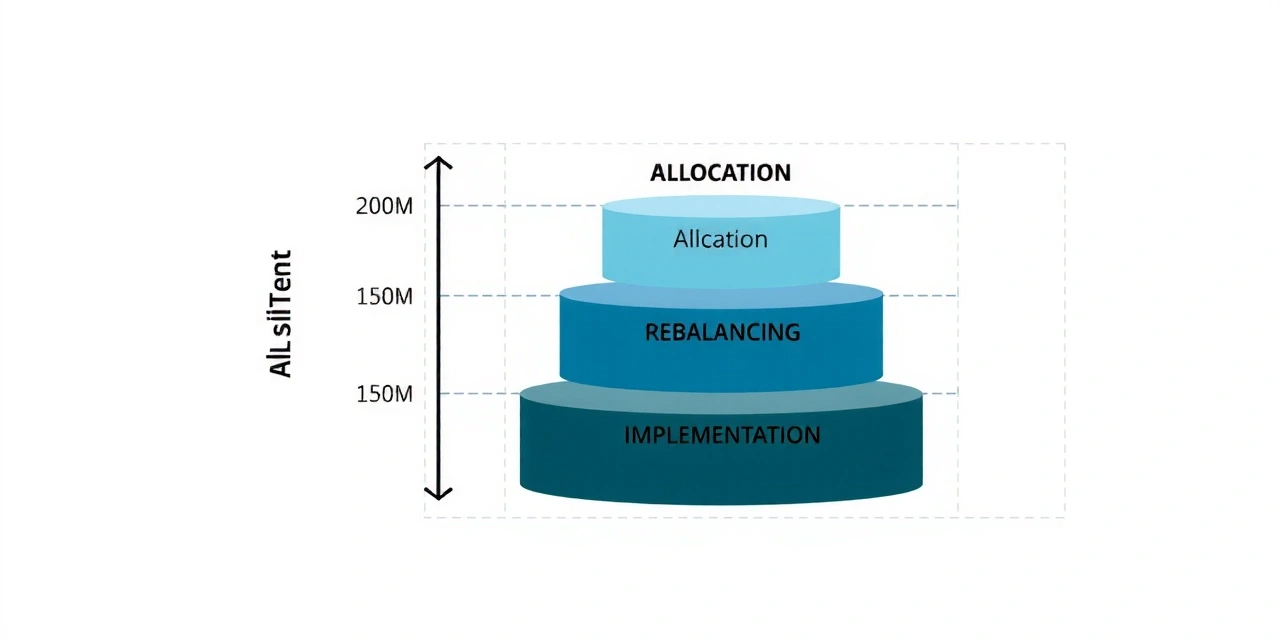

Our process is built on three pillars: strategic asset allocation, disciplined rebalancing, and cost-efficient implementation. We utilize a multi-asset framework to smooth returns and manage drawdowns.

Transparency is non-negotiable. Clients receive a quarterly Portfolio Health Report with performance attribution, fee breakdown, and risk metrics. Sustainability is integrated as a core screening layer, not a separate fund.

Portfolio Health Report Includes:

- Performance vs. Custom Benchmark

- Fee Drag Calculation (bps vs. AUM)

- Asset Class Attribution

- Risk Metric Trend (Volatility, Max Drawdown)

Decision Lens: Is Our Model Right For You?

Evaluate fit against these criteria. Our fee-only, independent model optimizes for transparency and alignment but has specific constraints.

Fee Transparency Priority

You want a clear, commission-free model with no hidden costs.

Complex Cross-Border Needs

You are navigating dual tax residency (e.g., DE/US) or have assets in multiple jurisdictions.

High-Minimum Active Management

You seek active strategies; our minimums reflect the bespoke work involved.

Pure Index/Robo-Advisor Preference

If you prefer automated, low-cost indexing without complex planning, we may not be the best fit.

Glossary: Our Terms

Nachhaltige Geldanlage

We prefer SFDR Article 8/9 classification as a starting filter, but client-defined criteria drive final selection.

Fee-Only vs. Commission

We are **fee-only**. We receive compensation directly from you, not from product providers. This aligns incentives.

Advisory Mandate

A discretionary mandate allows us to execute trades without prior client consent per trade, under an agreed IPS.

Liquidity Profile

A documented assessment of cash needs over 1–5 years. Critical for allocating to lock-up vehicles vs. cash equivalents.

Architecting Resilience: The Safety Net

Risk protection is a gap analysis, not a product checklist. We audit existing policies for coverage shortfalls in disability, liability, and long-term care.

Succession is a process, not an event. We map business exit strategies, family governance structures, and charitable intent. For a business owner, this often means structuring a Family Investment Company to facilitate tax-efficient transfer while protecting assets.

Client Scenario: Retirement in 2028

We modeled a 3.5% withdrawal rate against a 30-year horizon, stress-testing against inflation and market drawdowns. The plan included a bond tent for early years.